Strategic Offshore Trust Services: Tailored Wealth Protection

Wiki Article

Shielding Your Wealth Abroad: A Comprehensive Overview to Offshore Trust Solutions and Property Protection Methods

Are you wanting to safeguard your wealth and secure your properties abroad? Look no further. In this detailed overview, we will certainly walk you with the ins and outs of offshore count on services and the crucial considerations for possession security overseas. Discover just how to pick the appropriate territory for your offshore wealth management and explore techniques to lessen tax obligation responsibility with offshore counts on. Obtain ready to learn the most effective methods for shielding your wealth offshore.Recognizing Offshore Trust Fund Providers

You need to understand just how offshore depend on solutions can aid protect your properties and protect your wealth. Offshore trust fund solutions are a powerful tool for protecting your hard-earned money and possessions.Among the essential benefits of offshore trust services is the capability to preserve privacy. You can keep your economic events private and out of the spying eyes of others when you develop a count on in an international jurisdiction. This can be particularly advantageous if you are worried regarding possible legal disputes or if you simply value your personal privacy.

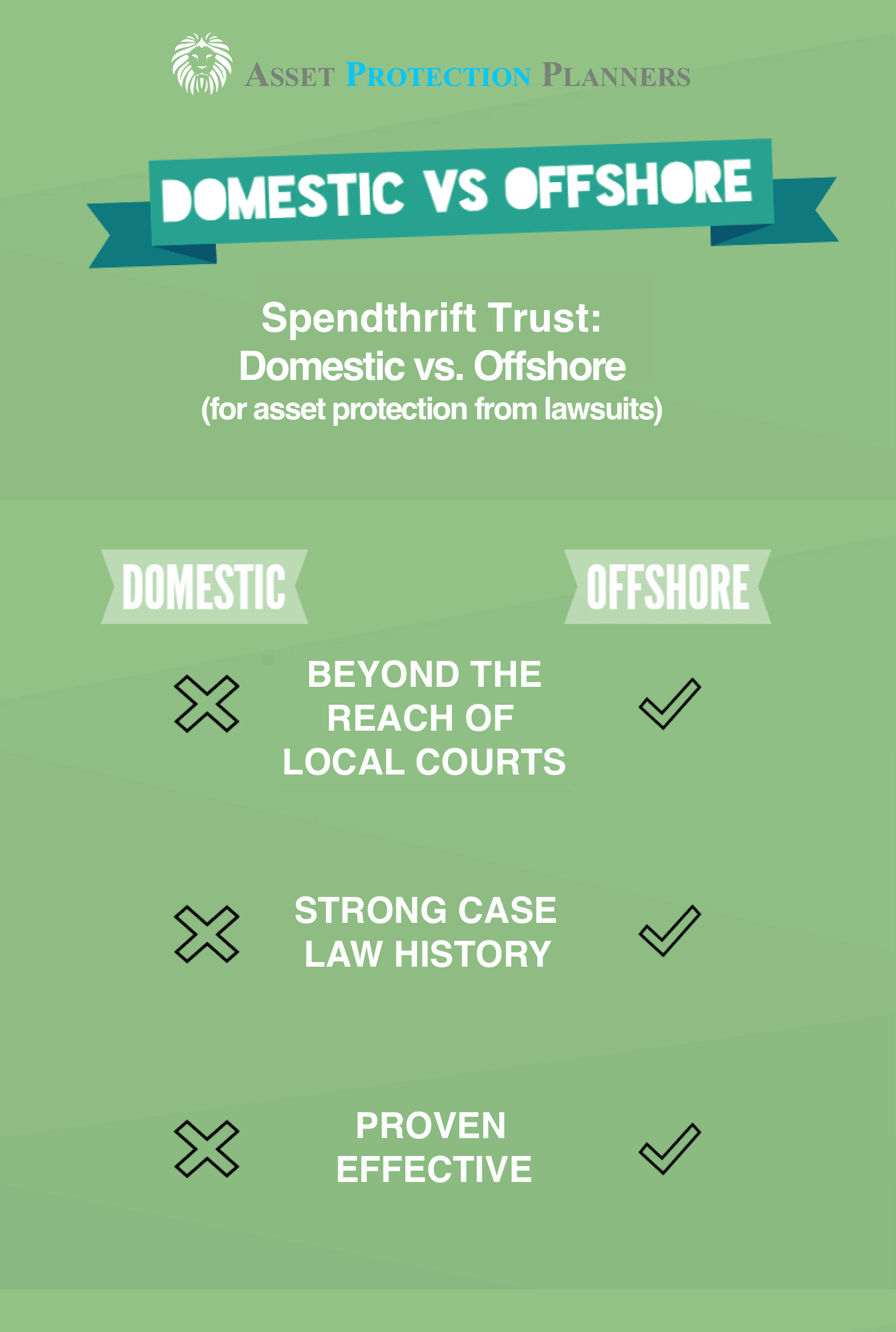

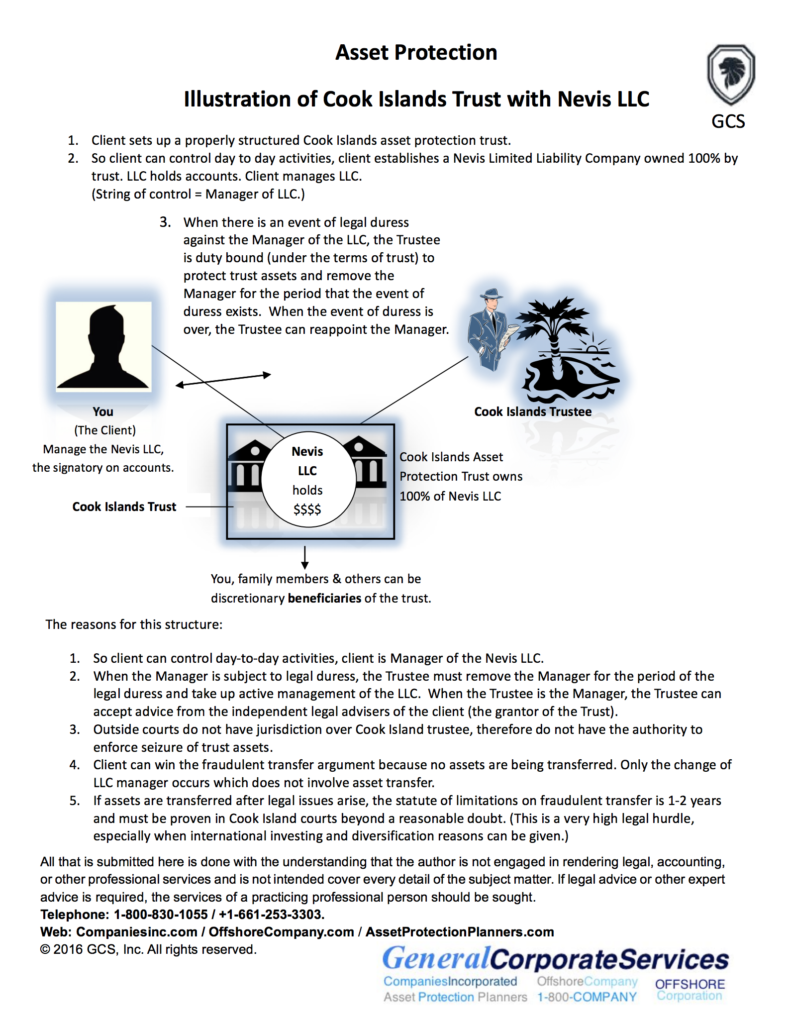

Moreover, overseas trust fund services provide better asset protection. In the event of a claim or various other economic obstacle, your assets held within the trust fund are shielded and can be challenging for financial institutions to reach.

Secret Factors To Consider for Asset Security Abroad

When thinking about property security abroad, it is essential to understand the key aspects included. One of the most critical aspects to consider is the legal structure in the chosen jurisdiction. Different countries have varying laws pertaining to property defense and privacy, so it's important to select a territory with strong regulations that straighten with your objectives.Another vital consideration is the reputation and security of the jurisdiction. You wish to choose a nation that is politically stable and has a solid legal system, as this will ensure the durability and efficiency of your property defense approach.

Additionally, the accessibility and top quality of professional solutions in the picked territory should not be forgotten. It's important to collaborate with knowledgeable attorneys, accounting professionals, and wide range supervisors who have proficiency in worldwide possession defense. They can lead you via the process and ensure that your properties are appropriately structured and secured.

Tax obligation effects are additionally a key variable to think about. Some territories use positive tax obligation programs, permitting you to legitimately lessen your tax responsibilities. It's vital to make sure that you abide with all suitable tax obligation laws and laws to avoid any potential legal problems.

Last but not least, it's crucial to very carefully assess the dangers entailed in asset defense abroad. Every jurisdiction carries its own set of risks, such as political instability or adjustments in regulations. It is necessary to perform thorough due persistance and have contingency plans in position to mitigate these dangers.

Selecting the Right Jurisdiction for Offshore Wide Range Monitoring

To effectively handle your offshore riches, it's important to carefully select the territory that lines up with your objectives and offers favorable legal and tax structures. By choosing the right territory, you can optimize the benefits of offshore wealth management and protect your assets from unneeded threats.Among the key aspects to take into consideration when choosing a jurisdiction is the legal structure it offers. Seek jurisdictions that have strong possession protection legislations and well-established legal systems. These jurisdictions should have a background of appreciating residential or commercial property legal rights and offering a safe and secure atmosphere for your offshore wide range. In addition, take into consideration the tax obligation framework of the jurisdiction. Some territories supply positive tax rates and motivations for offshore investors, enabling you to reduce your tax liabilities and optimize your returns.

Another important factor to consider is the online reputation and security of the territory. Look for territories that have a solid and dependable monetary system, as well as political and financial stability. A territory with a great online reputation will certainly not just offer a safe environment for your overseas wealth but likewise boost your integrity with potential company partners and financiers.

Finally, take into consideration the level of confidentiality and privacy supplied by the jurisdiction. Offshore wide range administration usually involves the demand for personal privacy and security of individual info. For that reason, pick a territory that has strict discretion laws and appreciates your right to personal privacy.

Methods for Decreasing Tax Obligation Responsibility With Offshore Depends On

Take into consideration utilizing overseas depends on as a means to reduce your tax obligation liability. By establishing an offshore trust fund, you can make use of numerous methods that can help minimize the amount of taxes you owe. One such method is referred to as tax obligation deferment. With tax deferment, you can delay paying taxes on income produced by properties held within the offshore Continued depend on up until a later date. This can be specifically useful if you plan on reinvesting the revenue, permitting it to grow and potentially creating much more wide range. Another approach is called tax exemption. By positioning certain properties, such as financial investments or real estate, into an offshore depend on situated in a jurisdiction that provides tax obligation exemption on these kinds of possessions, you can successfully remove the requirement to pay tax obligations on any kind of earnings created by those properties. In addition, overseas counts on can supply you with a degree of personal privacy and privacy, protecting your wealth from spying eyes - offshore trust services. It is crucial to keep in mind that making use of overseas trusts for tax preparation purposes need to be done in conformity with all applicable regulations and policies. Consulting with an expert expert that specializes in overseas trusts is extremely recommended to make certain that you structure your count on a legitimately audio fashion and fully recognize the prospective advantages and risks entailed.Protecting Your Wealth: Ideal Practices for Offshore Possession Defense

Among the vital advantages of offshore possession security is the capability to separate your personal properties from prospective liabilities - offshore trust services. By holding your possessions in an overseas entity, you create a legal splitting up that can secure your riches from creditors or lawful claims. This separation can show very useful in the occasion of unanticipated conditions, such as insolvency or legal actions

Moreover, offshore entities frequently offer boosted confidentiality and personal privacy compared to residential territories. By developing an offshore entity, you can maintain your monetary and individual details a lot more secure, minimizing the risk of identification burglary or fraud.

In enhancement to property protection, offshore entities can also give tax benefits. Several offshore jurisdictions offer desirable tax routines, enabling you to minimize your tax responsibility and potentially increase your wealth with time.

Verdict

By understanding the advantages of overseas trust fund solutions, taking into consideration vital aspects for possession security, selecting the ideal territory, and executing efficient tax strategies, you can protect your wealth abroad. Remember to always adhere to ideal practices for offshore property defense to make sure the security and long life of your riches.Discover how to pick the ideal territory for your overseas riches monitoring and check out strategies to decrease tax obligation liability with offshore trusts. check my source By selecting the appropriate jurisdiction, you can make best use of the benefits of offshore wide range administration and secure your possessions from unneeded dangers.

By putting certain possessions, such as investments or real estate, right into an overseas count on situated in a jurisdiction that uses tax exception on these types of possessions, you can effectively remove the need to pay tax obligations on any type of revenue produced by those properties.One of the vital benefits of offshore asset security is the capacity to separate your personal properties from prospective liabilities. By comprehending the advantages of offshore trust fund solutions, considering key variables for asset protection, picking the appropriate territory, and applying efficient tax approaches, you can secure your riches abroad.

Report this wiki page